pay indiana state property taxes online

To View Tax Bill and other Property Tax info. Please note there is a nomimal convenience fee charged for these services.

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Search for your property.

. Have more time to file my taxes and I think I will owe the Department. Search by address Search by parcel number. As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks.

INtax only remains available to file and pay the following tax obligations until July 8 2022. You may also register with or login to our website to view update and add parcels to your profile. On Tax and Payments Payment Details page click on the button Pay Now.

If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. For best search results enter a partial street name and partial owner name ie. Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction.

Please visit this page for more information. 124 Main rather than 124 Main Street or Doe rather than John Doe. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

Pay by phone toll free. Learn how and where to pay property taxes. Homeland Security Department of.

A 250 150 minimum processing fee is charged for creditdebit card payments and a 395 fee is charged for Visa and MasterCard Debit Tax Programs. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more. Tips for Your Job Search.

Pay my tax bill in installments. Please direct all questions and form requests to the above agency. Properties that are in the Tax Sale Process are not available online.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. Gain access to your online tax payment receipts. Choose real estate personal or mobile home property tax.

You MUST present your current Treasurers Spring andor Fall copy at the local bank along with your payment. Create an INtax Account. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247.

Review and select the propertyparcel you wish to make a payment towards. Property Tax Bills Tax Statements Property Sales. Only authorized banks can accept on-time payments.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. State tax due from line J of worksheet _____State Tax. You need to come in the office and bring cash or certified funds.

Main Street Crown Point IN 46307 Phone. Full and partial payments accepted. Beginning July 7 2022 no new registrations will be accepted via INtax.

Property Record Cards Assessed Values. The Marion County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law. Look up the property with all relevant documents attached to each parcel.

Corrections Indiana Department of. You will be transferred to a secure payment site to enter and process your payment. Associate all of your parcels for easy payments in the future.

If your Property is up for Tax Sale making payment online WILL NOT remove it from the sale. Take the renters deduction. Property Tax Deductions and Credits.

National Guard Indiana. Call 855-423-9335 with questions. Indiana Department of Revenue Estimated Tax Payment Form Estimated Tax Designation and Payment Area Complete the worksheet on the back of this form to figure your estimated tax payment.

PAY TAXES ONLINE at wwwpaygovus NOTE. Review all public property tax information through the GIS system. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

Indiana Career Connect. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. Jobs Marketplace.

State Excise Police Indiana. Criminal Justice Institute. E-Check Visa Mastercard Discover and American Express accepted.

To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. Online Tax Resources Paperless Billing Pay Taxes Online Paperless Billing Pay your property taxes online through Invoice Cloud. To pay online visit eNotices Online or to pay by phone call 877-690-3729 and use.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. There is a convenience fee for this service go to Tax Payment Conditions for more complete details. In addition eCheck payments are accepted online for a flat fee of 150 with ATM Verify Verification Services.

Claim a gambling loss on my Indiana return. Law Enforcement Academy Indiana. It will take 24 to 48 hours for your.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. You should also know the amount due. Know when I will receive my tax refund.

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. Property Documents Recorders Office. Find Indiana tax forms.

The Indiana Department of Revenue does not handle property taxes. Building A 2nd Floor 2293 N.

Tarrant County Tx Property Tax Calculator Smartasset

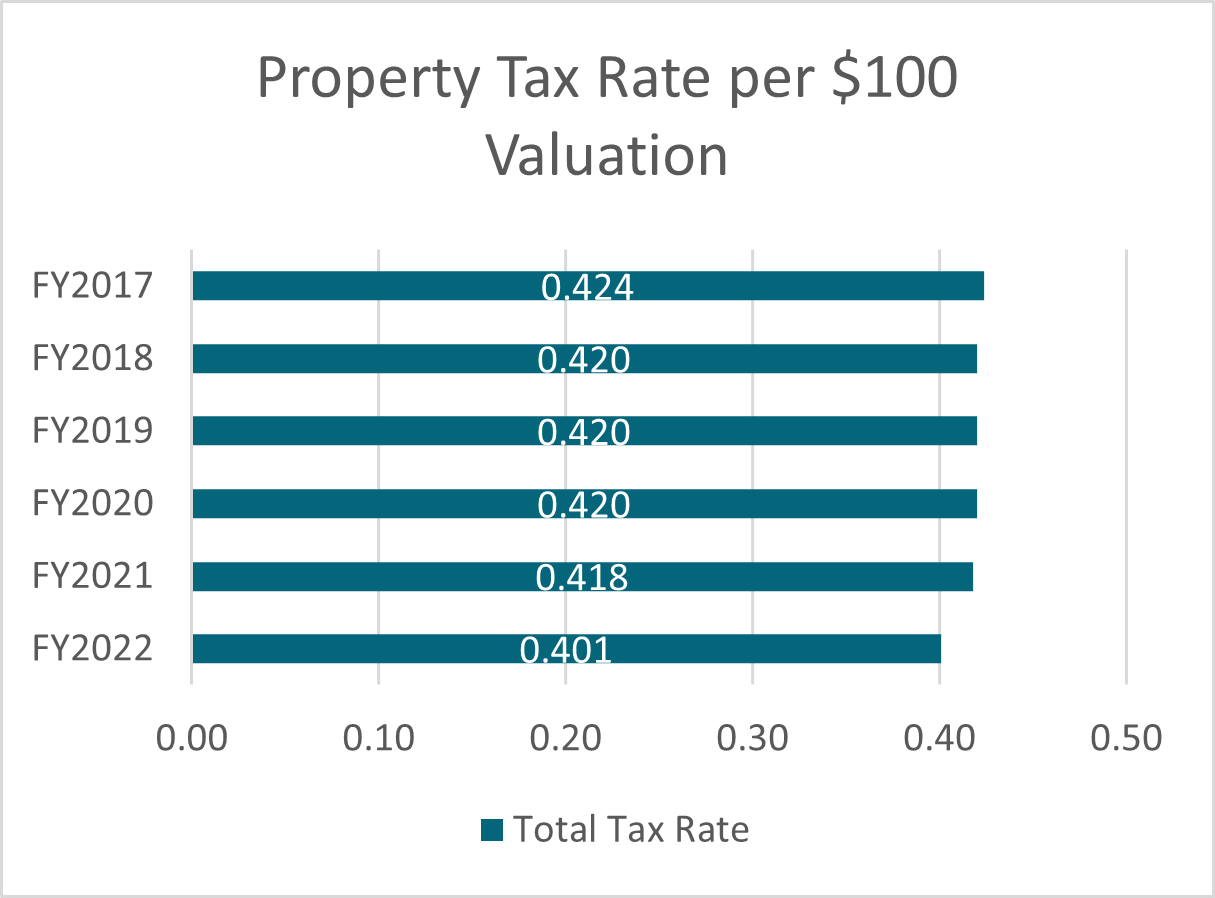

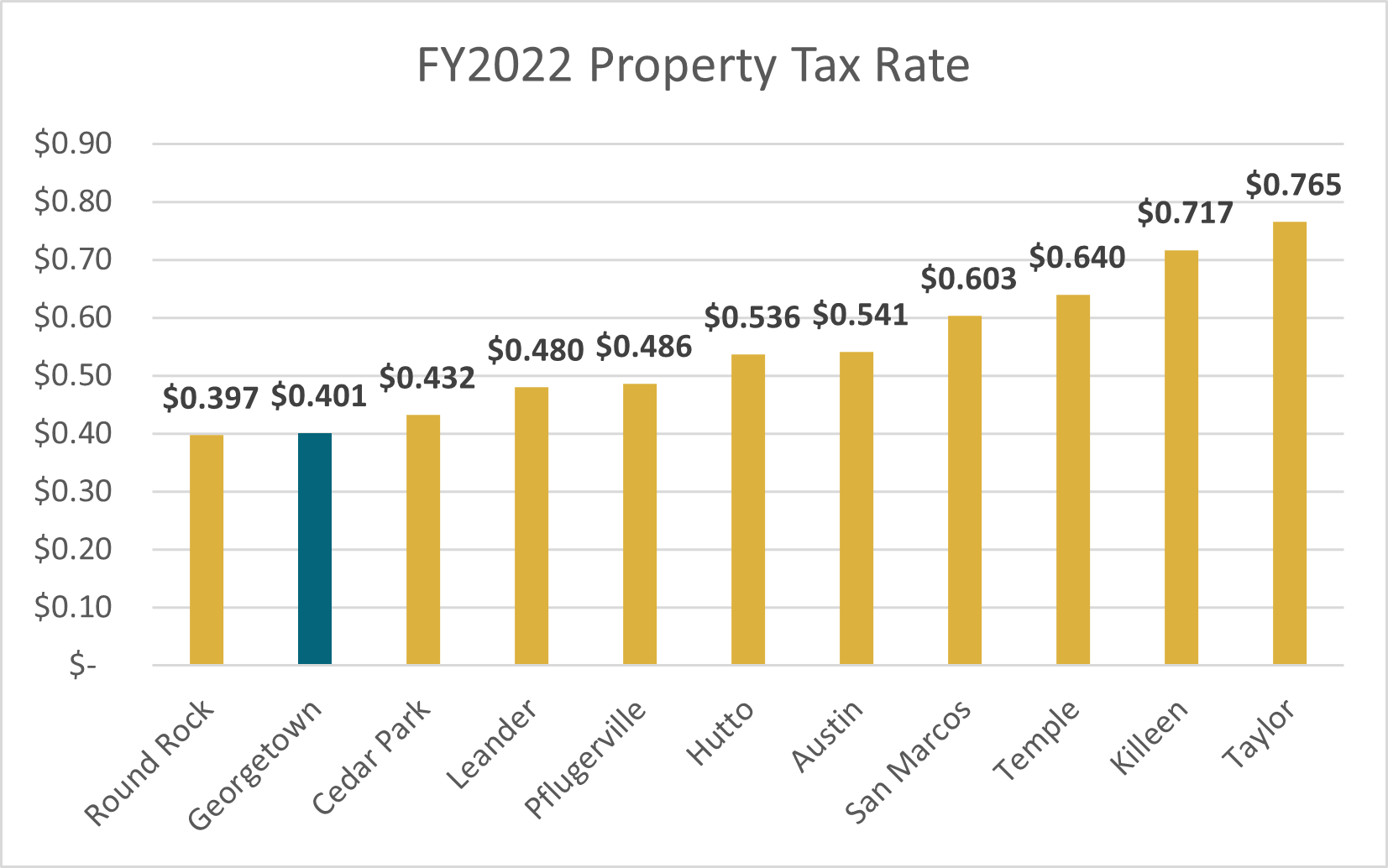

Property Taxes Georgetown Finance Department

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Taxes By State Embrace Higher Property Taxes

A Breakdown Of 2022 Property Tax By State

Real Property Tax Howard County

28 Key Pros Cons Of Property Taxes E C

Property Tax How To Calculate Local Considerations

Pennsylvania Property Tax H R Block