ct estate tax return due date

The estate tax is due within six months of the estate owners death though a six-month extension may be requested. State of Connecticut Check if amended return.

What S Considered A Late Rent Payment Can It Affect Your Credit Score

File Only With Probate Court Rev.

. 77-614 substituted commissioner of revenue services for tax commissioner effective January 1 1979. Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due date including extensions of Form 706 or the date of filing Form 706 if the return is filed late. When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a.

The tax applies only to the value of the estate above the threshold. The tax rate ranges from 108 to 12 for 2021 and from 116 to 12 for 2022. February 28 29 June 15.

If an estate is large enough Form 706 the United States Estate Tax Return is due to the IRS within nine months of the death of the deceased with a 6-month extension permitted. Steps to Completing Section 1 - Gift Tax. Adjustment for any difference in its value as of the later date that is not due to mere lapse of time 26 USC.

Do not use staples. File a 2021 calendar year return Form M-990T and pay any tax interest and penalties due. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by.

An example of. Due on or before December 15 2022. Connecticuts Gift and Estate Tax Estate Tax Basis Connecticuts estate tax applies to both resident and nonresident estates valued at more than the taxable threshold.

Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 2 million. 14 rows Click here for Income tax filing information. Form CT-706709 Connecticut Estate and Gift Tax Return 2020 CT-706709 Taxpayers must sign declaration on reverse side.

The 2021 Connecticut income tax return for trusts and estates and payment will be considered timely if filed on or before Monday April 18 2022. Generally the estate tax return is due nine months after the date of death. File your 2019 Form CT706709 on or before April 15 2020.

That goes up to 91 million in 2022 and 114 million in 2023. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months.

The individual federal estate tax exemption is 117 million for 2021 so an estate smaller than 117 million may not be faced with estate taxes unless the deceased. CT-EITC - If you filed 2020 Schedule CT. 2021 Form CT-706 NT Instructions Connecticut Estate Tax Return for Nontaxable Estates General Information For decedents dying during 2021 the Connecticut estate tax exemption amount is 71 million.

Due Date for Estate Income Tax Return. The estate tax rate is progressive and payable on the value of the entire taxable estate. Otherwise see April 19.

A resident estate is an estate of a decedent who was domiciled in. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. 0620 State of Connecticut Decedents last name First name and middle initial Social Security Number SSN.

All decedents estates required to file an estate tax return in Connecticut are presumed to have been resident in Connecticut at death and the burden of proof is on the decedents estate to prove. Estates Which Must File Only With Probate Court Form CT-706 NT Connecticut Estate Tax Return for Nontaxable. This due date applies only if you have a valid extension of time to file the return.

1971 act changed deadline for payment from 18 to 9 months from date of death effective July 1 1971 and applicable to estates of persons dying on or after that date estates of persons dying before July 1 1971 are subject to estate tax laws applicable before that date. Complete return in blue or black ink only. 2021 Connecticut Estate and Gift Tax Return Instruction.

For 2020 that threshold is 51 million. Form CT706709 Connecticut Estate and Gift Tax Return is an annual return and covers the entire calendar year. For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million.

Simplify Connecticut sales tax compliance. Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates For estates of decedents dying during calendar year 2020 Read instructions before completing this form Do not use staples. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 71 million.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. For more information see When to File Form CT-1041 on Page 10. Date Signature of judge Certifi cate of Opinion of No Tax I have examined this return and have concluded that no Connecticut estate tax is due from the decedents estate because the Connecticut taxable estate as shown above does not exceed the Connecticut estate tax.

The gift tax return is due on April 15th following the year in which the gift is made. Section 1 - Gift Tax. Mailing address number and street apartment number suite number PO Box City town or post office StateIf town is two words leave a space between the words.

State Corporate Income Tax Return Deadline Changes Wolters Kluwer

Irs Form 945 How To Fill Out Irs Form 945 Gusto

Secured Property Taxes Treasurer Tax Collector

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Tax Due Dates Town Of Fairfield Connecticut

Federal Income Tax Deadline In 2022 Smartasset

When Are My Taxes Due The Official Blog Of Taxslayer

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa

Property Tax Due Dates Treasurer

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The 2021 Tax Filing Deadline Has Been Extended Access Wealth

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Irs Announces 2022 Tax Filing Start Date

When To File Form 1041 H R Block

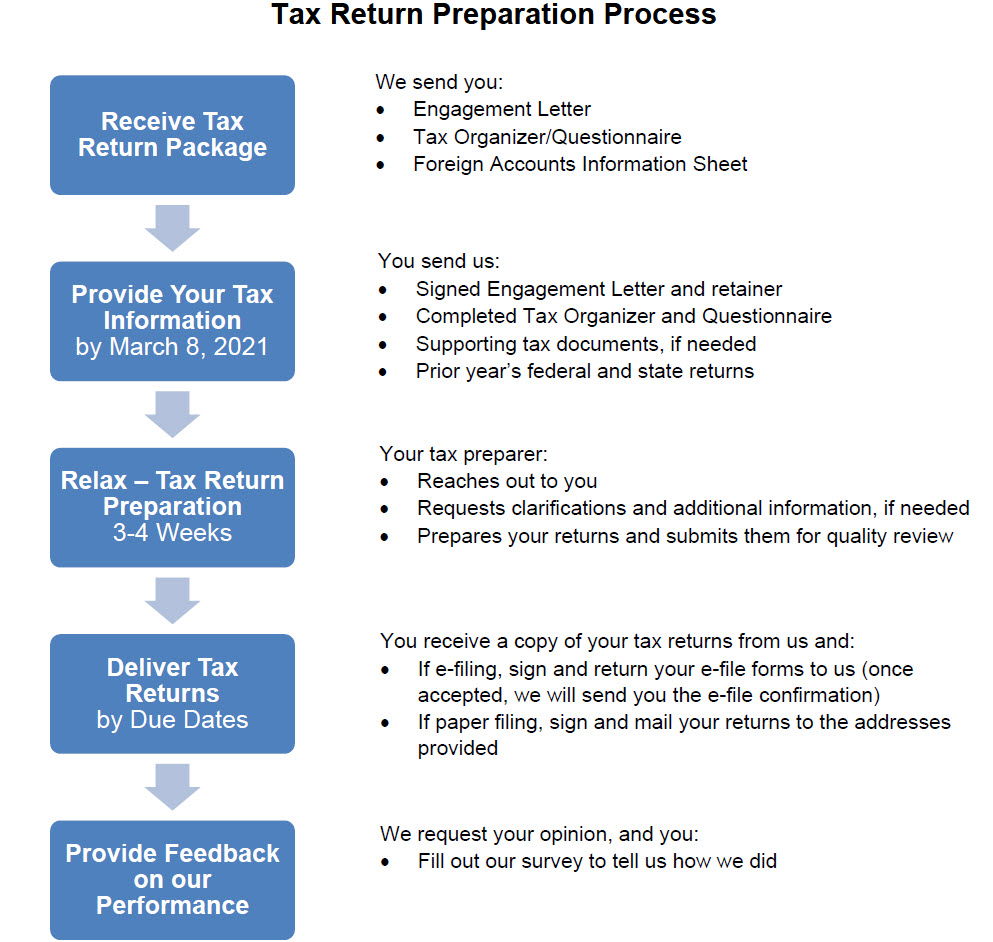

Tax Return Information The Wolf Group